September 20th, 2017

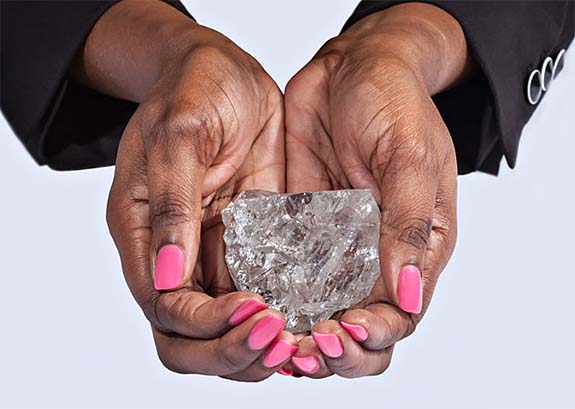

In mid-November 2015 — during a span of just 72 hours — Lucara's Karowe Mine in Botswana yielded three exceptional rough diamonds that tipped the scales at a combined 2,296 carats. Now, the government of Botswana wants first dibs on future historic finds.

A new clause in Botswana's Precious and Semi-Precious Stones Act compels mining companies to notify the minister within 30 days of coming into possession of an "unusual" rough or uncut diamond. The country's chief mineral officer said that a diamond "outlier" may be considered "unusual" if it demonstrates extraordinary size, quality or color.

The chief mineral officer told BusinessWeek that the government wanted an opportunity to celebrate as national treasures the museum-quality diamonds sourced at Botswana's mines.

Even though the Karowe Mine is 100% owned by Vancouver-based Lucara Diamond Corp. through its Boteti Mining subsidiary, the government of Botswana will have the right of first refusal on "unusual" diamonds. Purchases of rough diamonds would be made in accordance with the current market price.

Interpreting the market price of enormous gem-quality rough diamonds is not an easy task.

For instance, the largest of the three diamonds discovered in November 2015 still doesn't have a clear value. Named Lesedi la Rona, the Type IIa diamond weighed a spectacular 1,109 carats, making it the second-largest gem-quality rough diamond ever discovered. Lucara decided to circumvent normal diamond-trading channels and put the gem up for bid at Sotheby's in 2016. After the diamond failed to meet the $70 million reserve price (bidding stalled at $61 million), Lucara wondered out loud if the stone was just too big to sell.

Today, it remains unsold, and Lucara has seriously considered slicing the mammoth stone into smaller segments. Buyers have been apprehensive to make a play for Lesedi la Rona because of the enormous investment and lack of guarantees. Cutting a 1,109-carat diamond is uncharted territory, fraught with risks.

Lesedi la Rona's stablemates — the 813-carat “Constellation” and the 374-carat shard that broke off from Lesedi la Rona — were sold for $63 million and $17.5 million, respectively.

With Lucara employing new large diamond recovery (LDR) equipment and X-ray transmissive technology (XRT), the unveiling of the next massive rough diamond could be right around the corner. Under the new rules, Botswana will get first dibs.

Credits: Images courtesy of Lucara Diamond.

A new clause in Botswana's Precious and Semi-Precious Stones Act compels mining companies to notify the minister within 30 days of coming into possession of an "unusual" rough or uncut diamond. The country's chief mineral officer said that a diamond "outlier" may be considered "unusual" if it demonstrates extraordinary size, quality or color.

The chief mineral officer told BusinessWeek that the government wanted an opportunity to celebrate as national treasures the museum-quality diamonds sourced at Botswana's mines.

Even though the Karowe Mine is 100% owned by Vancouver-based Lucara Diamond Corp. through its Boteti Mining subsidiary, the government of Botswana will have the right of first refusal on "unusual" diamonds. Purchases of rough diamonds would be made in accordance with the current market price.

Interpreting the market price of enormous gem-quality rough diamonds is not an easy task.

For instance, the largest of the three diamonds discovered in November 2015 still doesn't have a clear value. Named Lesedi la Rona, the Type IIa diamond weighed a spectacular 1,109 carats, making it the second-largest gem-quality rough diamond ever discovered. Lucara decided to circumvent normal diamond-trading channels and put the gem up for bid at Sotheby's in 2016. After the diamond failed to meet the $70 million reserve price (bidding stalled at $61 million), Lucara wondered out loud if the stone was just too big to sell.

Today, it remains unsold, and Lucara has seriously considered slicing the mammoth stone into smaller segments. Buyers have been apprehensive to make a play for Lesedi la Rona because of the enormous investment and lack of guarantees. Cutting a 1,109-carat diamond is uncharted territory, fraught with risks.

Lesedi la Rona's stablemates — the 813-carat “Constellation” and the 374-carat shard that broke off from Lesedi la Rona — were sold for $63 million and $17.5 million, respectively.

With Lucara employing new large diamond recovery (LDR) equipment and X-ray transmissive technology (XRT), the unveiling of the next massive rough diamond could be right around the corner. Under the new rules, Botswana will get first dibs.

Credits: Images courtesy of Lucara Diamond.